Far too many Americans put off thinking about retirement. The New York Times reports that

Far too many Americans put off thinking about retirement. The New York Times reports that a study of the behavior of 401(k) investors by Hewitt Associates, a consulting firm in Lincolnshire, Ill., found that only 16.6 percent of 401(k) participants increased their contribution rates in 2005, the most recent year for which data are available. Nearly 10 percent, meanwhile, wound up reducing their savings rate that year.This presumes that you even HAVE a 401(k) plan!

THE younger you are the more impact incremental increases in your savings rate will have on your overall plan ... if you are 25 and have 40 years until retirement, every additional $1 you save will be worth $8.14 at retirement ... if you wait until you turn 40, each incremental dollar of savings will be worth $3.87 at retirement ... Even at 50, a dollar saved will be worth $2.32 by the time you turn 65.You may have heard the saying "we don't plan to fail, we simply fail to plan." If you fall into that category you might have to be a little more creative in your financial planning, which is exactly what Timothy J. Bowers did!

John Schwartz, in an essay for the Times, writes:

ONCE in a great while, an honest-to-goodness visionary shows up — someone who sees things in an utterly different way and helps to change our perspective as well.Schwartz goes on to mention:

Timothy J. Bowers is just such a man. His insights into the world of investing and retirement could reshape the way we look at the future. But you won’t find this giant in the case studies at Harvard Business School or sculpted in bronze on Wall Street.

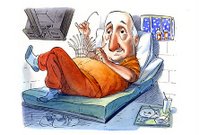

That oversight could have something to do with the fact that Mr. Bowers is serving a three-year sentence for bank robbery in the Hocking Correctional Facility in Nelsonville, Ohio.In May, Mr. Bowers entered a bank and handed the teller a note demanding four $20 bills. He then handed the bills to a security guard telling him it was his day to be a "hero." Bowers explained his actions to the judge this way:

he was about to turn 63 and had lost his job making deliveries for a drug wholesaler. He said that with only minimum-wage jobs available, he preferred to draw a three-year sentence, which would get him to age 66, when, he said, he could live off of Social Security. And that is what he got.Bowers solved his housing and health care problem with one simple act!

It seems Bowers had done time in the 70s and knew he could survive inside.

The prosecutor, Dan Cable, summed up for The A.P.: “It’s not the financial plan I would choose,” he said, “but it’s a financial plan.”Schwartz writes:

Now if you are a regular reader of this column (Hi, Mom!), you know that I’m all about unconventional plans for investors and outside-the-box thinking. But here’s a little inside-the-can thinking, and it’s got oomph. In fact, I’d call it incarcer-iffic.

Many investors found in 2000 that we’re just one market “correction” away from losing our nest eggs, and corporate scandals emptied out a lot of stock ownership plans. Employers, meanwhile, seem determined to whittle away at employee pensions and health plans. The pen could be the only safety net left.Schwartz tells us this could be the "ultimate 'buy and hold' strategy." And and you "don’t have to worry about the substantial penalties for early withdrawal. The funds are released when you are."

I guess if you look at it this way Schwartz is right when he says:

Once again, Jeff Skilling and Andrew Fastow of Enron are the smartest guys in the room. By going to prison, they are, again, simply out ahead of the pack.

No comments:

Post a Comment